Main Content

UK Budget 2021 – stamp duty absence extended to boost realty market

Chancellor Rishi Sunak has announced in Budget 2021 speech that the stamp duty “holiday” will be extended till June 30, 2021 in order to mitigate the impact of global pandemic induced lockdown. The move termed as a “massive relief” by the potential buyers especially, the ones who were amidst transactions and striving to complete them before the deadline – otherwise, they would be left with a hefty £15,000 tax bill.

Now let’s discuss in detail that how this holiday will work and what does it mean for the property buyers and potential investors.

How much stamp duty will you have to pay for buying a residential property?

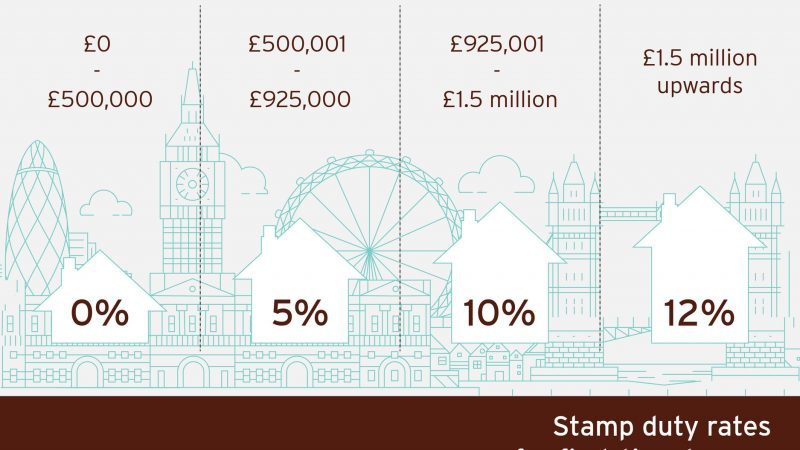

It is to note that the Treasury announced to raise the stamp duty threshold from £125,000 to £500,000 for property sales in England and Northern Ireland. And even after the deadline of June 30, the for stamp duty exemption will not be omitted immediately but the limit will be tapered from £500,000 to £250,000 until September 30. It will return to the normal level by October 1, 2021.

The stamp duty holiday is welcomed everywhere across the UK and a surge in the number of property transactions has been observed during the pandemic, which has also driven up the housing unit prices.

What are other significant barriers related to housing investment?

Stamp duty holiday is a remarkable step to stabilize the UK real estate market and shrug off the impact of corona virus led losses to the economy. However, for a number of young property buyers, collecting the deposit has always been a significant barrier to step up on the housing ladder. It was also catered in the recent UK Budget, where the chancellor announced a mortgage guarantee for the young and first time buyers.

Buyers can obtain mortgage with a deposit of only 5 percent of the value of a property under the plan to turn generation rent into generation buy. The program will bring 95% mortgages back from a government guarantee on those mortgages, which will help new property buyers having a smaller chunk of deposit. It is announced that the country’s leading lenders will start offering 95% mortgages from the next month and soon the others will follow.

What are the stamp duty holiday’s impact on housing market?

This is widely lauded by the UK real estate experts and serious property buyers who were previously unable to collect huge down payment and never get the chance to call a property their own. Prime Minister Boris Johnson said: “I want generation rent to become generation buy and these 95% mortgage guarantees help to deliver this promise. Young people shouldn’t feel excluded from the chance of owning their own home and now it will be easier than ever to get onto the property ladder.”

Prior to this relief, there were tens of thousands of on-going yet staggering and incomplete property transactions, due to the pressure to complete them before March 31 deadline. It was feared that if the stamp duty holiday lifted abruptly, it could lead to a significant disruption in the market – leaving countless property transactions at the verge of abandoning. Therefore, when the extension was speculated last week, the real estate experts welcomed it.

Sajid Bashir, the CEO of Copperstones Properties, said: “Saving up for a big deposit is challenging for most of the first time buyers and this particular segment of buyers is indeed adversely affected by the pandemic. A government backed mortgage guarantee scheme along with stamp duty saving will help the young generation the most, as previously the home ownership was a long distant dream for them.”

What are attractive real estate investment options for serious property buyers?

Newbie buyers can think of investing in properties worth up to £500,000 and Barratt Homes offers a large number of beautiful homes in different settings at different locations on the outskirts of London. For instance, Hendon Waterside is one such remarkable development by Barratt Homes that is located in Zone 3 and where you can find a number of investment worthy housing units. It is connected to London through a road network and residents can access central London under 30 minutes via Thameslink or Northern Line services.

Hendon Waterside is a mega project by Barratt Homes comprises of more than 2000 one, two and three bedroom new homes, being developed next to the scenic Welsh Harp Reservoir. It offers all the modern facilities in the development like retail shops, cafes, restaurants and a Co-Op supermarket and landscaped gardens.

Ridgeway Views is another exclusive residential project by Barratt Homes where they offer stunning ready to move in apartments and detached family homes. The beautiful homes are perched on hill top, overlooking the rolling green fields of Totteridge Valley. All the residences enjoy a natural green backdrop, making it an idea investment choice for nature lovers, who always look for small yet cozy home, equipped with contemporary facilities in the serene neighbourhood.

The development is also connected to London as Mill Hill East Underground station is a 10 minutes’ walk from the development and from there it takes 25 minutes to reach central London. The new West orbital line will add tremendous vale to capital growth and reduce travel time to Heathrow. Moreover, residents can find all contemporary and lifestyle facilities within the development including retail shops, cafes, restaurants, parks and schools.

These are our top picks for you, if you want to make the most from stamp duty holiday period and also struggling to save a hefty deposit. Pick up your phone, dial us at 0203 888 5555 and discuss your investment plan with us and our experts will tailor a customized plan for you with a number of properties to fit into your budget. Hope to hear from you soon.

Please submit your enquiry and a member of our team will get in touch with you soon.